I’m generally of the opinion that the socialist Left is in need of more analysis of political economy, and that this analysis should be geared towards the most general audience possible. For that reason I was glad to see something to that effect published in Cosmonaut in the form of Ted Reese’s recent piece on the possibility of the popping of various bubbles and a general crisis of capitalism. I do, however, have some critiques of the way this analysis was accomplished. Reese’s mode of analysis focuses on listing a large number of empirical facts and using these to suggest conclusions to the reader, a mode he also employed in his 2022 book The End of Capitalism: The Thought of Henryk Grossman, when he turned from a historical recounting of Grossman’s thought to an analysis of the contemporary prospects for a capitalist breakdown. This approach, I believe, can be misleading at times, as well as disorienting. What connects these various facts together; how exactly should we understand them in an objective fashion, beyond the thesis of any given book or essay?

For example, in his article we are told:

In the run up to the Great Depression, all active home mortgages represented 10% of the US’ GDP, rising to 32% in 1930. US mortgage debt today is 70% of GDP, more than $18 trillion in total household debt. (In Australia and Canada, mortgage debt is higher than the country's entire GDP.)

The rapid expansion of margin debt, the total amount that investors have borrowed to buy securities—which fuelled the 1929 crisis—reached a record high of $1.1 trillion in September, up by 34% on 2024. The private (non-bank) credit market is exploding at a rate of around 15% a year, rising from $0.5 trillion back in 2012. Drawing comparisons to the 2008 subprime housing crisis, US subprime used-car lender Tricolor filed for bankruptcy in September after it allegedly pledged the same loan portfolios to multiple lenders, exposing private credit providers and major banks such as JPMorgan, Barclays, and Fifth Third to unexpected losses, with its filing listing up to $10bn in assets and liabilities.

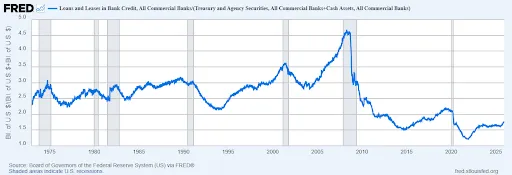

How are we to make sense of these numbers? The rise of debt under neoliberalism has indeed been precipitous, but that’s precisely why it doesn’t necessarily entail an impending crisis, there is no certain level of debt at which everything will suddenly collapse. Since 2008, for example, banks have had higher reserve requirements, and if we compare the ratio of loans to safe cash and cash-like assets (treasuries), while rising it is still at historic lows, lower than at any time between 1973-2008.[1] Those losses caused by Tricolor going under sound quite large, but what is $10bn compared to the $2.9tr in cash reserves held by the banking system? It is 3/10ths of a percent. Now, this doesn’t mean that a banking crisis is impossible. Smaller banks have lower reserve requirements and in the past few years have had many riskier assets dumped on them by larger banks, and then there's the shadow private lending sector to worry about. But what’s required here is precisely a theory of the case. Without such a theory, there is little reason to expect a particular outcome, nor is there much that can be learned after the fact.

Occasionally Reese gestures at such a theory in Marxist economics:

As the general rate of profit falls, investment opportunities dry up, resulting in ‘overaccumulated’ gluts of surplus money capital that cannot be profitably reinvested. Karl Marx’s contention that this immanent barrier to innovation and productivity growth tends to grow ‘more formidable’ is illustrated in many ways: by the record high prices of cryptocurrency, gold, and speculative stocks, for example; and the amount of dead cash amassing in US money market funds, hitting $7.5 trillion in 2025, up by a phenomenal 33% in just three years.

The problem with this analysis is that under neoliberalism there has been no such secular decline in profit rates and cyclically it has only begun to stagnate rather than fall at any speed that would be comparable to previous crises.[2] It is not good practice to attribute such and such empirical phenomena to falling profit rates without actually checking direct measures of profit rates to see if they’re falling. Certainly, the measures required to prevent the fall of profit rates under neoliberalism themselves may be contributing to these phenomena. For example, in order to prevent higher investment rates and therefore rising depreciation costs as a share of value, financial rent seeking has become the primary pursuit of the US bourgeoisie.

All of this is to say, empiricism and the sensuous realities of market movements are not the basis for genuinely Marxist analysis of political economy. What is required of us is a rigorous theoretical practice which duly processes each of these facts based on a scientific theoretical framework.

I do believe that, from such a framework, it does seem that neoliberalism and the US role in the global economy, in particular, would not survive the next crisis. It certainly would be nice if socialism was the natural outcome of such a collapse. But more likely, and indeed more in line with Marx and Engel’s theories, would be the emergence of a new, more authentic state capitalism similar to that practiced in China, which would be capable of increasing investment rates to an extent to actually threaten the reproduction of the capitalist class (where the old state capitalism failed).[3]

One cannot naively extrapolate from existing empirical trends to decide one way or another, even if we must take account for these trends, as doing so lends easily towards wishful thinking and cherry picking of the trends we are so interested in. Certainly, theoretical practice is not free from ideological motivations, but it’s only with reference to an objective theoretical system that we can articulate statements about our reality and our future which even rise the level of being able to be wrong and generate genuinely scientific knowledge.

-Nicolas D Villarreal

Liked it? Take a second to support Cosmonaut on Patreon! At Cosmonaut Magazine we strive to create a culture of open debate and discussion. Please write to us at submissions@cosmonautmag.com if you have any criticism or commentary you would like to have published in our letters section.

-

“Loans and Leases in Bank Credit, All Commercial Banks/(Treasury and Agency Securities, All Commercial Banks+Cash Assets, All Commercial Banks) | FRED | St. Louis Fed,” Stlouisfed.org, 2025, https://fred.stlouisfed.org/graph/?graph_id=1550587.

↩ -

“Gross Domestic Income: Net Operating Surplus: Private Enterprises/(Consumption of Fixed Capital: Private+Gross Domestic Income: Compensation of Employees, Paid) | FRED | St. Louis Fed,” Stlouisfed.org, 2025, https://fred.stlouisfed.org/graph/?graph_id=1550590.

↩ -

Nicolas D. Villarreal, “The Chinese Encounter.” Pre-History of an Encounter, October 15, 2025, https://nicolasdvillarreal.substack.com/p/the-chinese-encounter.

↩