Is the economic calculation problem a valid argument against planned economies? Max Black argues that this so-called problem is based on flawed reasoning and that a world beyond markets is possible. Reading: Robert Fisher.

One of the defining aspects of the communist movement is its demand for the abolition of the “anarchy of the market” and its replacement by a rationally planned economy, an economy defined by common ownership of society’s forces of production. This makes communism as a movement distinct from other socialist camps such as Proudhonian mutualism, which argues for a market economy based on the application of a moral principle—in the case of the American anarchist Josiah Warren, that principle is summarized as “cost the limit of price.” The Marxist critique of capitalism, on the other hand, aims to show that no such moral principle can override the social regularities or iniquities of power that define the capitalist market economy, or overcome capitalism’s tendency to produce centralized and concentrated accumulations of capital. Marx demonstrates that, taking “free and fair exchange” and private property as givens, these social relations will necessarily generate economic crises and the division of society into classes.

The validity of Marx’s critique has been realized in history. As capitalism developed, capital ceased to be the property of individual capitalists. Social ownership sneaks into the capitalist system through the invention of joint-stock corporations, in which thousands of individuals own shares in an enterprise and collectively govern it through an elected board of directors. The ascent of trusts—combinations of joint-stock corporations which control an entire industry—seemed to bear out Marx’s critique to such an extent that Friedrich Engels saw these as a negation of capitalist ownership altogether. The next logical step—the ownership of capital by the state—seemed to be on the horizon with the advent of the First World War. State direction of the economy would be the natural “dialectical” development of capitalism, which would make the proletariat’s historical mission of the abolition of class society possible through wrenching state power—which now included economic power—from the hands of the bourgeoisie.

In the midst of this, non-socialist schools of political economy begin to investigate the possibility of non-capitalist economic systems. While Marxists at the time failed to put into writing any detailed blueprints of a socialist economic order, Enrico Barone, an early neoclassical economist and follower of Vilfredo Pareto, put forward a model of a socialist economy to demonstrate in the abstract the feasibility of an alternative economic order. Rival schools of economic thought, such as the Austrian School of economics represented by the likes of Eugen von Böhm-Bawerk and later Ludwig von Mises and Friedrich von Hayek, came to challenge this model.

The Economic Calculation Problem

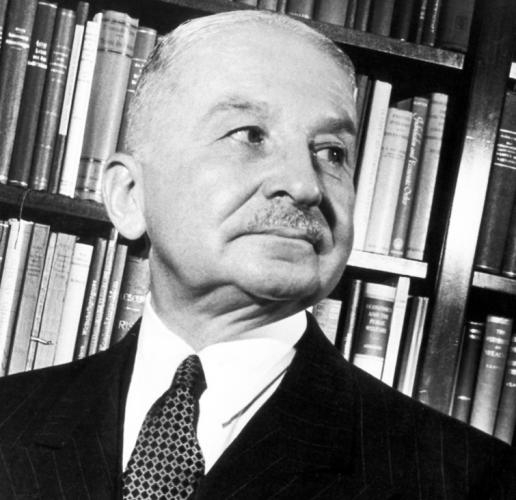

The Economic Calculation Problem is most famously put forward by economists of the Austrian school. Ludwig von Mises put forward his initial critique of “socialist calculation” in 1920 with the publication of his essay “Economic Calculation in the Socialist Commonwealth.” Max Weber, also of Austrian nationality and a friend of Mises, would provide his own contribution to the debate, published posthumously, forming a chapter in his 1922 work Economy and Society. Both Mises and Weber focus on the requirements of decision-making that face both capitalist and socialist planners and come to the conclusion that socialism is “impossible” (not merely “inefficient” or “undesirable”) as socialist planners lack a decision-making calculus by which to find the best organization of production.

Mises and Weber begin by analyzing an abstract description of the capitalist production process. They note what tools capitalists use in their decision-making process: the price system, which provides commensurable monetary values by which to compare commodities, and profit and loss accounting, which signals to the capitalists which sectors of their enterprise are functioning effectively. Mises in particular stresses that the price system is generated by an economic order defined by competition between owners of private property, and that without this competition between owners, there is no way to generate a price system with real referents to supply and demand. Socialists, by abolishing private property, also abolish competition. By abolishing competition, socialists abolish the price system, and this, according to Mises and Weber, leaves socialist planners “groping in the dark.”

Weber poses the problem this way:

[A]n enterprise is always faced with the question as to whether any of its parts is operating irrationally: that is, unprofitably, and if so, why. It is a question of determining which components of its real physical expenditures (that is, of the ‘costs’ in terms of capital accounting) could be saved and, above all, could more rationally be used elsewhere. This can be determined with relative ease in an ex-post calculation of the relation between accounting ‘costs’ and ‘receipts’ in money terms, the former including in particular the interest charge allocated to that accounting. But it is exceedingly difficult to do this entirely in terms of an in-kind calculation, and indeed it can be accomplished at all only in very simple cases. This, one may believe, is not a matter of circumstances which could be overcome by technical improvements in the methods of calculation, but of fundamental limitations, which make really exact accounting in terms of calculations in kind impossible in principle.1

And Mises, in his Economic Calculation in the Socialist Commonwealth:

Anyone who wishes to make calculations in regard to a complicated process of production will immediately notice whether he has worked more economically than others or not; if he finds, from reference to the exchange relations obtaining in the market, that he will not be able to produce profitably, this shows that others understand how to make a better use of the goods of higher order in question.2

This insistence that the price system is generated by the distributed actions of private property owners is essential to the problem, and it is, at least, a correct summary of the capitalist economic process. While neoclassicals such as Barone imagined a socialist state capable of generating a price system which would be used by planners to allocate resources, the Austrian School took umbrage with this notion, claiming that a price system isn’t able to generate accurate information without the institutional framework which defines the capitalist system. That is, without private property and without competition, a price system that provides commensurable values for the basis of comparison between two distinct types of goods isn’t possible. It is the distributed behaviors of capitalist agents which provide a meaningful price system as this system aggregates distributed knowledge in the capitalist economy in a manner useful to any planners. While this aspect of the problem would be elaborated later by Hayek, it is implicit in the description of the problem advanced by Mises and Weber.

The Problem Reconsidered

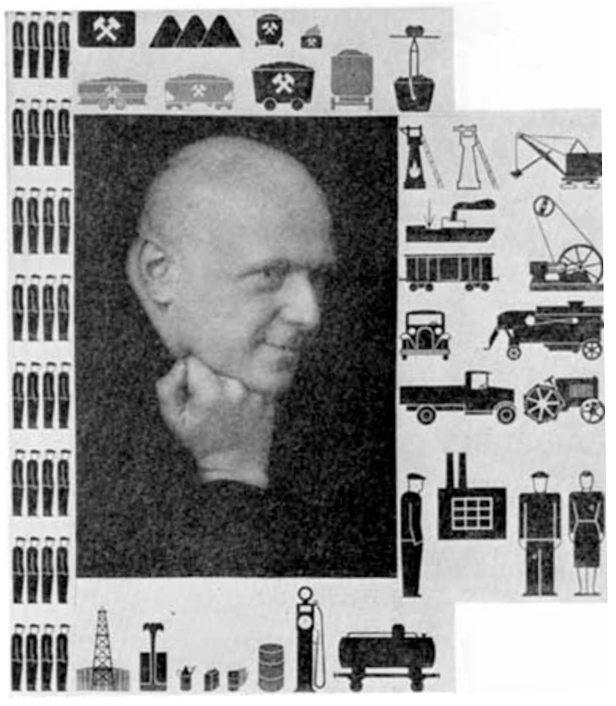

The need for a commensurable value to compare between two goods is a foundational assumption of the problem. If this assumption falls away, then the possibility of a socialist economic order is established. One of Mises’s interlocutors, Otto Neurath, pointed to such a possibility. Neurath proposed, but never saw to completion, a project of accounting in purely natural units (units such as “tons of steel,” “gallons of water,” etc.). Neurath’s proposal, called “calculation in natura“ (as well as “calculation in kind”), was dismissed as impractical by Mises and Weber. In Neurath’s discussion of the problem with Hayek toward the end of Neurath’s life, Hayek remarks with astonishment that Neurath doesn’t take it as a given that a price system is necessary to make rational decisions within the economic sphere. (Indeed, Hayek’s Nobel Prize speech begins with Hayek stating that he will assume no one will argue for an in-kind calculus, and then proceeds to make his case for a price system as an information feedback system.)

Neither Mises, nor Weber, nor the later Hayek provide any formal, rigorous proof that an in-kind calculus is truly impossible. The impracticality of an in-kind calculus is simply taken as an assumption and used to dismiss the idea altogether. Mises and Weber argue that an in-kind calculus would require the comparison of “innumerable” processes and raw materials and that these, in and of themselves, would not reveal the preferable course of action anyhow. Only profit and loss signals can reveal to producers whether or not they made the “rational” decision, and profit and loss signals require a monetary calculus. Furthermore, the price signals enable producers to choose between raw materials, as the money prices of members of a set of possible raw materials allow producers to calculate the amount of money needed to produce one unit of a good, and thereby predict profitability.

Mises and Weber, by referring to “economic rationality,” however, are really referring only to the rationality of the capitalist who is organizing production to pocket the profit. Rationality never exists for itself but is always used in the service of some goal. The talk of “economic rationality” in this vague and general sense obfuscates the goal of capitalist rationalization, which is profit-making itself. What Mises and Weber prove is not the impossibility of socialism, but simply that socialist planners would have to rationalize production around a different objective than the maximization of monetary profits (or the minimization of financial risk). By restricting “economic rationality” to the rationality of profit maximization, the economic paradigm promoted by Mises and Weber also restricts the study of economics only to the commercial social relations of certain historical societies.

The impracticality of an in-kind calculus may have seemed evident under the conditions which defined Mises and Weber’s era. This was the era of pen and paper where digital computers had yet to be invented, and no algorithm for the rationalization of resource use around given constraints had been developed. These tools would not be developed until the Second World War necessitated them. The number of calculations required to solve a particularly complex optimization problem before the invention of linear programming techniques and other mathematical optimization tools was, indeed, very numerous, although not always “innumerable.”

Mises and his successors suggest, essentially, that all economies are holistic, complex systems, where controllers (capitalists or socialist planners) must make decisions with some kind of information toward some kind of goal. For Mises, monetary calculation via the price system is the only possible means of reckoning, outside of simple cases or a household economy. Profit and loss is the only information feedback system available. Is this realistic? Economic processes produce plenty of information that can be captured, objectivized, and speedily communicated. Assuming a proper inventory-tracking system, consumption of resources from a warehouse or store generates information that can be captured, communicated, and processed by a computer system. These kinds of systems already exist, because the price system itself does not contain enough usable information to give firms in really-existing capitalist economies the ability to orient themselves among competitors. Large national and multinational firms depend on automatic inventory systems—updated as soon as goods are purchased—and, increasingly, automated decision support systems in everyday business processes. These systems can never make decisions based on price signals alone if they even take prices into account or interface with the open market at all. They employ the “innumerable” data generated by business processes to arrive at decisions in an imperceptibly fast time.

To top this off, production processes today rarely depend on buying from actors within a competitive market. In large companies, buying raw materials and inputs for the production of new commodities occurs according to contractual agreements with prices set by contract. In these instances, competition is clearly restricted. It is not uncommon for whole supply chains to be established by contractual agreements, i.e. not by open market exchanges, and automatically planned according to point-of-sale events and other sources of information to predict future demand. The Misesians overstate the extent to which monetary calculation alone is depended on in the capitalist system.

The epistemological assumption that one needs commensurable values to decide between which types of raw inputs to use is a mere assumption, and Mises and Weber make it clear that it is, in fact, possible to determine which is best in the simplest cases, leaving room for more complex cases to be solved, assuming a generalizable algorithm exists. In the absence of a rigorous proof, it can not be assumed one way or the other. Finally, this assumption of commensurability, combined with the identification of profitability and economic rationality, falls victim to what Neurath called “pseudo-rationalism.” That is, it assumes there is only one correct or optimal solution, revealed by the application of some general problem-solving method. This is not the case. Markets do not generate “optimal” solutions in any sense, and nor do the firms which interface with the market. Firms and markets—like the command economies of the twentieth century—simply muddle through. If some people go hungry, they go hungry; if some go without medicine, they go without medicine. The fact that market economies themselves do not ensure a minimum standard of living has long been a critical point of the socialist movement—however, it is a point that the advocates of the calculation problem are happy to dismiss. These are seen as worthy punishments for the unproductive, a necessary means of keeping people in line. Moreover, such poverty is taken as the natural state of mankind, and if one does not give in to the demands of the market—identified with rationality and civilization—then one deserves what one gets.

The opposition to economic planning is rooted in a pessimistic view of humanity. Hayek and Mises accept that life is a bellum omnium contra omnes (a war of all against all). They view markets and commerce as a bastion of civilization among the inherent brutishness of life. Trade and exchange, which give us comforts in the midst of natural poverty, are what separate human beings from animals. Markets, then, are a source of order, “spontaneous” order according to Hayek, an order which does not need direct state force to cohere, but instead can depend on punishment meted out by an impersonal institution, through the ostensibly uncoordinated actions of private actors.

Calculation beyond markets/Profits beyond reason and reason beyond profits

The assumption that “economic rationality” can be arrived at on the basis of profit and loss signals is explicit in the work of those who propound the economic calculation problem as fatal to socialism. Profit-making can be described, however, as Richard Weaver describes radio programming, as “a ‘rationalization’ which results in the wildly irrational.” The classical “tragedy of the commons” scenario—where we imagine two farmers, each on one side of a pasture, who are attempting to maximize their use of the pasture, to the detriment of one another—is, for example, a tragedy made possible by the blind pursuit of self-interest between two or more agents. The scenario can be solved, not by eliminating the commons through enclosure, but by regulating the commons as a commons, through collective association that unites the users of the common-pool resource under a single management, dictating the commons’s terms of use.

Fishery collapse perhaps illustrates this best. Fisheries are common resources, but are often not treated or recognized as such and are nonetheless exploited by multiple agents. In a capitalist society, these agents are in competition with one another, leaving the fishery unmanaged, as the legal institutions of this society generate adversarial relations between the fishermen who use it. As these independent and competitive fishermen rationalize their catch around the constraint of individual profit maximization, they inevitably over-exploit the stock of fish. An immense environmental irrationality emerges out of the distributed actions of agents following the profit motive: fishery collapse imperils not only the fishermen but anyone dependent on the fisheries as a nutritional source. Empirically, attempts to solve for this issue by introducing greater property rights or a market regime often fail to produce the desired effect. The most successful means of fishery management typically involves recognition of common ownership and collective management of common resources.

With Mises’s identification of profitability and rationality, we run against Otto Neurath’s dictum that there is no single method appropriate for the solution of all economic problems. Mises buckles into a “pseudo-rationalism” that views the market, private property, and profit signals as cure-alls for economic malady, as a technical solution enabling the singular correct course of action, or at the very least the only available solution for solving economic problems (even if irrational results emerge, Mises might say, there is no alternative). This conception of “economic rationality” is indefensible in the face of the environmental devastation wreaked by capitalist development the world over, in which profit-and-loss signals dictate the extermination of indigenous peoples, the clearcutting of forests, the removal of the tops of mountains, etc. The individual rationalities of the capitalist calculators do not cohere into a total social rationality but instead cascade into a general irrationality. Mises’s economic calculation, then, cannot be confused or naively identified with “rationality” in the most general sense, the sense which Mises would seemingly prefer to use it.

“Economic rationality” in a grander sense than “is this economic process profitable to the business owner” is only possible with calculation in natural units. Planners, socialist or otherwise, need to know current stocks, rates of depletion and replenishment, the number of agents involved, and so on. These figures are available at least in the form of estimates. Importantly, the market and private property by themselves cannot prevent the total depletion of the commons. In fact, the depletion of the commons follows inexorably from the distributed actions of agents following profit and loss signals. It is only when private property is circumvented, where information not revealed by prices or profit and loss signals is taken into account, that sustainable use of common resources becomes possible.

While most research on common resource exploitation does not offer the radical suggestion of the abolition of monetary accounting (most models, in fact, assume that the agents involved are motivated by entrepreneurial concerns), the discussion of the commons generated since Hardin coined the term “the tragedy of the commons” demonstrates that enclosure and private property do not solve the “tragedy” in and of themselves. This calls into serious question the ability to identify profits with “economic rationality” and demonstrates the need for information feedback that is unavailable from the price system or profit and loss signals.

An institutional framework which not only enables but necessitates the strict adherence to individual rationality at the expense of wider society is to blame for the degradation of the commons. Even when the commons is organized as such, it is organized still in an interface with the market. The goal is not the sustainable exploitation of the fishery, but the increase in profits, at all costs, of each individual. A point that Mises concedes early on in “Economic Calculation“ is important here: the system of monetary accounting inherently excludes the value of human and non-human life to exist for its own sake. Everything increasingly comes under the domain of money and commercial, profit-driven relations, and what is held in common is degraded if not outright enclosed.

Conclusion

Mises’s economic calculation problem has, since its initial formulation, provided anti-communists with a source of hope that not only is an alternative organization of society undesirable but that it is simply impossible. Any attempt to change society through alteration or abolition of the institutions of private property and markets will result in catastrophe. The assumptions which underlie the problem, however, are not realistic enough to accept. One must take seriously the claim made, on the basis of no formal proof, that calculation in natural units is impossible, and therefore calculation by monetary accounting is the only option. One has to assume that various courses of action can only be compared if they are commensurable or expressible in the same single unit of account. Finally, one must accept that profitability and economic rationality are identical. These pillars, as shown, are not adequately supportive of Mises’s total claim that a rational economic order can only be formed from through the institutions of private property and the market.

Finally, if distributed, uncoordinated entrepreneurs following nothing but their own self-interest generate the tragedy of the commons scenario, it is disingenuous to call Mises’s positive proposals “rational” in any general sense. Mises proposes that entrepreneurs are rational, and they are, but Mises fails to show that rational actors in relation with one another generate a system that can be called “rational” as a totality.

It might be the fate of humankind that our economic systems will forever be far from rational when viewed as a totality. This is a point that not only Mises but also Otto Neurath would be happy to concede. To speak of the possibility of alternative social orders requires us to not simply recognize that the current order is already mired with inefficiencies, but to also prove that an alternative organization of society would actually fare better by some metrics. It may be that socialists must concede that our preferred system will mean a lower variety of consumer options, given the lack of incentives for entrepreneurial activity that capitalism encourages. This is something I would be willing to concede if defenders of the capitalist order are willing to concede the total irrationality of the capitalist mode of production when the constraints considered involve not only profitability but the rational use of environmental inputs.