2: The Size and Economic Impact of Labor Aristocracies

2.1: Growth and Stagnation

Aside from the question of its objective interests, another controversy surrounding the labor aristocracy is the question of its present-day size. Hobsbawm and other British labor historians estimated the Victorian labor aristocracy to take up some 12-15% of the workforce.[1] Lenin mentions the figure of 20%, referring to the total membership of the craft unions in Victorian Britain or wartime Germany, elsewhere referring to the labor aristocracy as a “thin upper crust.”[2] The question of its latter-day size is altogether different: J Sakai (in)famously argued that some 80% of the US population constituted a vast labor aristocracy, which he identified as a primarily racially-privileged stratum.[3] Third-worldist authors have suggested that the question of labor aristocracy can only be considered on the scale of whole nations, and so 100% of the US is aristocratized. As we will see there are certain technical reasons concerning the mobility of labor make this proposition less ridiculous than might first seem, even if we should ultimately disagree. The vitriol surrounding these modern debates, which has polarised Marxists between extremes (it is often either 0% or 100% of the core working class that is aristocratized), hides the fact that the precise size of the labor aristocracy is a relatively unimportant question since there is very little relationship between the size of a class or class strata and the prominence of its ideas in public life.[4] More important is its position in a political hierarchy, and as we will see the labor aristocracy has not maintained a consistent position.

Lenin was aware of these problems of calculation. The present size of the labor aristocracy in terms of its basic economic life, the present size of the population with labor aristocratic politics, and the portion of the working class that would follow opportunism even in a global revolutionary period are all different, albeit loosely related, questions:

Neither we nor anyone else can calculate precisely what portion of the proletariat is following and will follow the social-chauvinists and opportunists. This will be revealed only by the struggle, it will be definitely decided only by the socialist revolution.[2]

Nonetheless, it can be helpful to attempt the broadest kind of estimate. If I were to attempt to give a percentage figure based on something concrete, I would say that a little over half of the US working population is in a contradictory class position between the proletariat and petty bourgeoisie, since we know that around half have undergone some kind of concrete embourgeoisement through securing profit incomes.[5] However for some, these are insignificant quantities in superannuation schemes and so forth, and we have already seen that there are very high-waged workers with no investments, so it is difficult to draw a fine line.

Such estimates of size in these terms give little idea of the political influence of this strata. In the US it was vastly more powerful during the heights of the New Deal Coalition, a bourgeois-labor fraction within the Democrats, even though the strata was much smaller at the time. In fact, I would go so far as to say that the size and power of labor aristocracies is often inversely correlated.[6] A smaller labor aristocracy that has to fight for its existence against other classes and strata wields its power in a different way compared to a large, stable aristocracy that is partly absorbed into the petty-bourgeoisie. Moreover, the larger the labor aristocracy is, the more intense the competitive pressures within it will be, acting to depreciate the aristocratic wage relative to the general wage, although there are ways to maintain an elevated position despite this.

It may be reasoned, as Hobsbawm and others did, that after a certain point the massive size of this strata makes the term “aristocracy” dubious. But this ignores the international dimension. Even if the labor aristocracy is a significant part of the working class in core countries, it is still a very small minority on a global scale. To put this in perspective, if we are to say that roughly half of the working population in the 34 highest-income countries is in a labor aristocratic class position, then this would only include about 3.9% of the world population, or 9.2% of the recorded working population.[7] But this isn’t to minimize the threat of this segment either: what is dangerous about the labor aristocracy has little to do with its size, but rather its aspiration to class leadership, and its strength in times of intensified struggle.

The growth of the labor aristocracy between Lenin’s time and the present was tied to large state or union-led wage increases, to various kinds of yellow unionism, and to class collaborationism in political life. With this came the failure of any internationalist solidarity that might have prevented such an enormous gulf in wages between the imperialist countries and their periphery from forming. With the exception of some settler-colonial countries, this gulf was largely formed between the leadup to the First World War, and the period following the Second, that is, between 1890 and 1960. If there was only a small difference between core and peripheral wages in 1900, by the latter part of the 20th century the average core wage adjusted for purchasing power was between 10 and 30 times that of the periphery, a gulf which is still relatively unchanged half a century later.[8] In section 2.2 we will see the effects of this divide.

2.1.1: “Lower and deeper, to the real masses”

An obvious question here is if there was a general rise in core wages over this period, then what is the point of discussing this as an issue of just one stratum? After all, even the most oppressed sections of the working class in the core saw at least some wage increases during the interwar to the postwar period, as well as other benefits. This would be true even if we think that wage rises are unproblematically the result of a rise in surplus-value contributed by core workers. Why is it that high-value-added production should be concentrated in only a handful of countries? Clearly, if we are looking for a means of absolving the working class of the core countries, in whole or in part, of any suggestion that it may have ‘benefited’ from imperialism, then we won't find one no matter how hard we look. Neither Lenin nor Engels shied away from this conclusion, although it was clear that there were various degrees of benefits:

These benefits were very unequally parcelled out amongst them; the privileged minority pocketed most, but even the great mass had, at least, a temporary share now and then.[9]

It is for the best then that benefits don’t seem to significantly impact the politics of strata unless it is conscious of them, or until the benefits are so great that it causes a real change in class relations. While this has certainly occurred in the core countries, it has been far from universal. It should be obvious to anyone who cares to look that alongside the history of the labor aristocracy, the bourgeois-labor parties, and the yellow unions, there has always been a countercurrent of dissent. This has not just been the insincere nitpicking of the out-bureaucracies, but also a genuine (albeit often weak or misled) current of proletarian internationalism and anticapitalism. This too has a class basis in the core countries.

That being said, it is true that the entire working class of core countries benefits from wage rises, even if they are initially concentrated in certain skilled sectors. This is because in any market economy where there are not significant barriers to labor mobility (such as borders, migration controls, extreme national or racial sectoral specialization, etc.) there is a strong tendency for wages to even out over time due to competition on the labor market. If the difference in wage rates between two sectors in the same country is too great this will lead to labor shortages in the lower-waged sectors and an oversaturation of higher-waged sectors. Considered in purely economic terms this would result in some capitalists raising wages to retain workers and others lowering wages due to the glut. However, since there are usually considerable political barriers to any absolute fall in the wage rate, there is also a tendency for this equalization to occur through a slight rise in the general rate of wages, ie. by raising the wage of low-waged workers more often than lowering the wages of the highest-paid workers.

This rise in general wages occurred alongside a change in the ratio of skilled to unskilled labour: over the 20th century the number of skilled workers in the core grew, while the premium paid for skilled work was reduced, representing increased competition, however at no point was there a significant general drop in skilled worker wages.[10] In the present-day core countries it is virtually unheard of for wages to be cut in absolute, nominal terms, rather a steady rise is expected, and if there is any drop then it is one of real wages relative to rising inflation. In some countries, like the US, the post-Bretton Woods period of stagnation was so severe that there was a quite significant drop in real wages, however, during 2019 these returned to pre-1973 levels.[11] Despite cases like the US, the tendency across all core countries has been for wages to rise in both real and nominal terms, though this rise has not been in proportion to the rise in the mass of profit. Institutional or union-led wage rises in one privileged sector can overflow into other sectors in the same nation, provided there is some labor mobility, only to stop at the border, where there is very little. This is why there is often vastly more similarity between the wages of different sectors in the same country, compared to the same sectors in different countries.

Another important point of clarification is that even though most wage increases over this period were not purely the result of changes in the value and quantity of labor power, it does not follow that there were no changes at all in the surplus value contributed by core workers.[12] While privileged sectors pioneered wage increases through national craft unions and bourgeois-labor parties, there were also other changes taking place among the class. There was an uneven global distribution of certain capitalist innovations such as changes in management techniques and labor-saving technological advances, which either took some time to reach the periphery or were locked behind patent law. There was also an unevenness in the reforms secured during periods of bourgeois-labor government, which often had the effect of increasing the average skill of the whole workforce. Mass education was a key factor here – while peripheral countries obviously also underwent periods of reformist governance their gains were limited by imperialism and their level of accumulation. While the core countries were able to establish mass university entrance or technical education, many peripheral countries struggled to maintain basic literacy rates. The ratio of skilled workers to unskilled also rose in the core over the 20th century, with the ratio of skilled to unskilled labor rising by 12% in the US and England between 1900 and 1950, and rising in all OECD countries in the next half-century.[13] Related to this was what Emmanuel described as a rise in the “organic composition of labour”: the ratio of abstract labor hours to the total number of workers. This rise is directly related to the high concentration of the most technologically intensive kinds of manufacturing in the richer countries, though this has reversed somewhat due to the increasingly skill-intensive manufacturing centers of China.

All of this is to say that an increase in the general rate of wages does not necessarily signify a drop in surplus value, however at the same time a rise in the mass of surplus value (a rise in s) is not always proportional to a rise in wages (v). We can find ourselves in a situation where both magnitudes rise, but the rise in wage costs can be greater than the rise in surplus value, and therefore there can be a rise in the mass of surplus value without a rise in the rate of surplus value (the mass divided by wage costs or s/v). This distinction will be important in section 2.2.2. In practice, it is often the case that unions will advocate for wage rises in tandem with secondary demands for added workplace training, or schemes to allow workers to undertake study and professional development, etc. Such practices help to justify the wage rise post hoc by pointing to increases in efficiency, an effective means of class compromise. Indeed on a social scale, periods of reformist government tend to coincide with mass education schemes, and it is safe to suggest these have had an effect on production, even if this effect is not sufficient to explain wage rises as simply a result of added skills.

In addition to the rise in the mass of surplus value in the core, there were also increases in the basic cost of subsistence. Nowhere on Earth is there more than a sevenfold difference between the core and peripheral basic cost of subsistence (see note 58) – this is again hardly enough to explain wage differences, and calculations of real wages already take this into account – but when we also consider the disproportionate rise in costs which affect poorer workers in core countries (such as rents, see below), the higher reproduction cost of labor of higher average skill (in schooling, training etc.), and the growth in various sectors which aim to maximize the absorption of waged or welfare income (see 2.2.3), it becomes easier to see why a more precarious, relatively poor strata of the working class persists in core countries. To return to our US example, some 38% of the US population has an income at or below its reported cost of reproduction.[14] Of course, this reproduction cost is a socially-determined variable that includes a “historical and moral factor” that covers certain costs which wouldn't be considered essential everywhere. However, this does not detract from the point that a considerable part of the US working class is not capable of savings or investment without immiserating itself, and so is more completely dependent on the market for labor.

Sections of the core population are also struggling not just in spite of, but sometimes because of the scale of wage increases. One effect of large-scale embourgeoisement is the tendency towards petty speculation and investment in real estate, to such a point that it’s relatively common to find landlords who still gain the majority of their income through wages. The increase in landlordism and property speculation has created enormously high housing costs in the core countries, which has in turn been a boon to loan and real estate capital, but has effectively pulled up the ladder behind the first round of investors. The petty landlord section of the core working class has thus become parasitic on the renting segment, and has naturally sought to erect further barriers to lock this relationship in place. This is nothing new, and the general pattern of aristocratisation allowing one segment of the class to erect additional costs on the other is repeated again and again as we look around the economy, a process of social capture.

Further contradictions within the working class of the core countries can be found if we turn to the racial and gendered effects of labor aristocracy. Countries with large labor aristocracies have a contradictory relationship to racial underclasses and migrant labor. On the one hand, high wage costs create an insatiable demand for low-waged migrant labor, especially in “undesirable” sectors (hard agricultural labor, cleaning, aged care). Local capitalists import migrant labor, or recruit from a reserve army of local oppressed nationalities.[15] Local workers and business unions have tended to resent these newer inductees into the labor force for the perceived competitive pressure they place on wages, but over time the mobility of labor between sectors evens out competitive differences, and migrants become assimilated into the working population or find a niche outside the labor market (in particular kinds of small business etc.). This can help explain the pattern of the initial intense rejection, but gradual assimilation of migration waves in economic terms, although there is of course still an interwoven cultural and political dimension. A very common exception to this pattern of assimilation exists in the case of minorities for whom there is an overwhelming strategic need among the bourgeoisie to maintain a separation from the general working class.[16]

Finally, it shouldn't be forgotten that the period of the greatest growth in global wage differentials coincided with a considerable setback in the rights of many working women in developed countries. Over the first half of the 20th century, it became common for reformist wage campaigns to be fought around the moral notion of a “breadwinner wage,” a wage that could allow a sole worker to support a large family and keep his wife out of work, preserving the bourgeois family against the moral decay that would otherwise follow. Of course, the notion of a golden era prior to women’s entry into the workforce was a bourgeois fantasy – proletarian women had been working since the dawn of capitalism, but lapsarian narratives are powerful and provided a moral impetus for an alliance between retrograde sections of the workers’ movement, churchmen and conservatives. It also suited the Fordist ideal of a workman perfectly reproduced each day by a devoted wife, ready to work as an automaton for 8 hours. While this association of higher wages with breadwinning was partly overturned by women’s liberation movements of later decades, it was nonetheless a powerful moral factor in the wage increases of the interwar period and postwar period, and its reactionary allure continues to haunt regressive sections of the working class many decades later.

These contradictions in the core working class, between the upper and lower strata, between racial aristocracies and oppressed peoples, or between genders, each represent ways the class has been turned against itself and weakened. This does not mean that the more oppressed strata is more ‘left-wing,’ in fact the opposite is often true. While it is often possible to overcome these sectional interests, they do shape the terrain of political struggle, and it would be very foolish to ignore them through reductionism. Such reductionism can take many forms: one type is a class-reductionism common in opportunist politics, which suggests that there is no such thing as sectional privileges, and these are effectively a theoretical abstraction that can be overcome by simply insisting on the presence of shared class interests, regardless of the real presence of class consciousness and complexification of objective interests. The second kind we might call “national reductionism,” the idea that national sectional interests override any other factors, and sections of the population are thoroughly united by racial or nationalist-imperialist interests.[17] Clearly there are cases where national and racial labor aristocracies do exist, wherein there are virtually no workers of the oppressor nation who are unaware of the benefits they receive and the absolute necessity of their continued participation in a regime of supremacy. However, such situations rarely exist in a pure form. We will see that both kinds of reductionism are misleading, as while there are certainly many benefits of imperialism and unequal development that are felt by whole national working classes, these tendencies are also subject to countertendencies and exceptions.[18]

2.1.2: The Shift in the Late 20th-century

If by the middle of the twentieth century the leadership of several labor aristocracies stood politically victorious over their rivals to the left and right, by the 1960s this situation had begun to reverse itself. While the labor bureaucracy had achieved considerable success through political domination of the bourgeois-labor parties (or similar formations like the New Deal Coalition) in several countries with the introduction of basic welfare states, the involvement of unions in management or planning in key industries, and very large wage increases, most of these victories were reversible. Some of these victories were dependent on shaky alliances with bourgeois factions, while others were in fact victories of the industrial unions, which were not forcefully maintained once these were tamed by entry into business union federations.[19] There is an inherent transience to any advancements by a class that refuses to confirm its victory in the form of a class dictatorship, but it is also worth exploring the partial defeat of the mid-century regime of compromise in more concrete terms.

First, it is important to note that the political fates of the labor aristocracy in developed countries are to some extent tied to those of the national working class as a whole. Its leaders are politically strongest when a radical alternative to their class leadership presents itself, against which they can prove themselves a loyal opposition. Thus it is also stronger when the organized proletariat is larger and more prominent in society. Many of the reversals the labor aristocracy saw in the latter half of the twentieth century weren’t specific to it particularly but were instead symptoms of the active disorganization of the whole working class in the core countries. This is true of the various technical changes in the composition and organization of production in imperialist countries, starting in the postwar period.

The active disorganization of the working class in the developed countries was overdetermined, and played out differently in different regions – it was hardly reducible to some single, global factor like “financialization.” I say “disorganization” rather than “decline” since in many countries there was no absolute decline in the size, economic well-being, or even the militancy of the core working class. The growth of the manufacturing sector and growth in the rate of wages only slowed, while the number and intensity of strikes often increased. And yet the working class and its aristocratic leadership were politically and organisationally neutralized.

This process was spearheaded in the US. By the 1960s the manufacturing sector was undergoing dramatic changes in response to a peculiarly American problem of considerable technical debt and obsolete capital stock. The US, like many imperialist countries, saw a postwar boom and dramatic growth in manufacturing, however, unlike its closest competitors in continental Europe and Japan, the US had seen no great capital write-off as the result of wartime destruction. It was also encumbered with outdated management and planning practices, as well as endemic overproduction compared to overseas “lean” manufacturers like Toyota. The answer in the US was, at first, the usual response of capital to a rising cost of intensive growth: capital flight. In the beginning, this was only a flight away from the great steel and automotive centers towards more underdeveloped US towns, a decentralization of production away from motor cities and towards suburban or regional ‘mini mills.’ Uprooting production from areas with decayed capital stock also allowed capitalists to restructure in new locations, with roboticized lean manufacturing guided by computerized planning systems like MRP and Kanban, or later APS and ERP. Both the decentralization of production and automation of planning had the hardly incidental effect of greatly weakening the hold of the unions, both through cuts to labor, a shift to working populations that were less unionized and more spread out, and edging the aristocratized leadership out of certain management or planning roles it had become integrated into. The changes were first felt among the core of the old industrial unions, such as the Black proletariat in America’s North. The AFL-CIO was by this time too integrated into the state and industry to resist (or perhaps too busy concentrating on adventures with the CIA), and only responded with strikes well after the writing was on the wall, a pattern replicated by many business unions in other core countries.[20] Such changes are commonly blamed on the oil crisis from 1973, which certainly dealt a significant blow to the automotive industry, but the changes had begun due to competitive pressures some years earlier – deunionised branches were able to outcompete their US rivals and remain competitive with overseas industry, a competitive displacement that occurred slowly, starting in the 60s and lasting into the 90s. The rate of US de-unionization was similarly slow and steady between 1960 and 1980, at 0.4% per year.[21] As the rate of accumulation began to outstrip new investment opportunities in the US interior, an increased portion of the US social product began to be devoted to overseas growth, AKA offshoring, although this was hardly the death knell of core manufacturing it is sometimes made out to be. The illusion of industrial decline is instead more of the product of newer, more capital-intensive industries in the core countries absorbing the investment previously dedicated to traditional industrial mass employers, which had experienced sharp declines in profitability, such as the shift from Appalachian coal mining and processing to Appalachian shale gas.

In Europe, the political death of the labor bureaucracy was much more drawn-out. Aside from the case of France, where like the US the unions were small in terms of membership if not political influence, European union membership was very high, and its decline began much later than elsewhere. Here it was not so much economic pressures as geopolitical factors which were most important; indeed manufacturing in Germany and a few other countries remained highly competitive until relatively recently, and in Scandinavia and Belgium the yellow unions remain quite large, having avoided the membership decline suffered in other countries.[22] Aside from outliers like France, the European countries saw a slow rise in unionization up until 1991, after which there was a general decline. In the more volatile realm of parliamentary politics, the shift was more dramatic: European bourgeois-labor parties consistently gained an average of about 30% of the popular vote from the postwar period to 1991, suffering a temporary setback after the oil crisis, only to see their vote share enter an irrecoverable dive immediately after 1991.[23] The European example, which so clearly shows a drop in votes and unionization at precisely the moment of Soviet dissolution, begs the question of the role of geopolitics in the decline of labor aristocratic politics. The class struggle is fundamentally global, with victories and defeats being felt across borders, and the collapse of the USSR was the greatest of all recent defeats. The USSR was not involved in propping up bourgeois-labor parties directly, but there is a sense in which European social democracy was dependent on the implicit threat presented by the Soviet workers’ state, justifying its existence as a loyal anti-communist alternative in working-class politics. The same is true, if only on the most abstract level, of the labor aristocracy itself: if no communist alternative exists, then its primary political expression (a powerful labor bureaucracy integrated into the state) can be set aside for the moment, an irrelevant hindrance to capital that no longer serves a broader purpose.

I have been careful in this section to limit my claims to the relative, political decline of the labor aristocracy. I do not think it has been eliminated, or numerically depleted, insofar as it exists as a set of class positionalities. Nor have most of the uneven reforms secured by bourgeois-labor parties in the past been entirely reversed, and in the case of wages, they have remained almost exactly the same relative to the periphery. Still, a lack of political power explains the stagnation of the rate of reforms and wages. One key to this relative political decline has been the elimination of a perceived potential for revolutionary politics in the core countries, in light of which the leadership of the labor aristocracy finds it harder to forge cross-class reformist alliances as it once did. The implication then is that if this potential were to return to the core countries, so too would the dormant political power of the labor aristocracy.

2.1.3: ‘Re-proletarianization’

For many authors on labor aristocracy, the question of the future revolutionary potential of the working class majority in imperialist countries rests on the question of ‘re-proletarianization:’ a hypothetical return to proletarian class positionalities and politics. With each new expression of the labor aristocracy thesis, new means by which the privileged strata might be reabsorbed into the proletarian mass have been proposed.

Engels was certain that since the English labor aristocracy depended on the British trade monopoly, it would be absorbed back into the masses once Britains’ imperial rivals began to catch up and break into the same markets:

The truth is this: during the period of England’s industrial monopoly the English working-class have, to a certain extent, shared in the benefits of the monopoly… And that is the reason why, since the dying-out of Owenism, there has been no Socialism in England. With the breakdown of that monopoly, the English working-class will lose that privileged position; it will find itself generally — the privileged and leading minority not excepted — on a level with its fellow-workers abroad. And that is the reason why there will be Socialism again in England.[24]

Engels even lived to see this belief confirmed to an extent, as a wave of English radicalism in the 1890s seemed as though it would sweep away the ‘old’ unionism of the previous decades.[25] Kautsky would use arguments drawn from this passage against the idea of a labor aristocracy in the following decades.[2] While the British labor aristocracy did not entirely collapse in the 1890s, it certainly shrunk, as British industry underwent increased mechanization in response to greater competition on international markets. The British trade monopoly was the condition for a greater demand for skilled workers since it allowed otherwise uncompetitive skilled semi-handicrafts to dominate the English economy, but it didn’t prove to be the essential precondition for aristocratization.[26]

As discussed earlier, Lenin held a somewhat similar belief that as the inter-imperialist rivalries deepened, the ability of several countries to maintain privileged strata would be reduced. The living conditions of such strata would decline due to wars, austerity, and crisis. He too lived to see a period of radicalism partly enabled by war-weariness and disillusionment with inter-imperialist rivalry. This would prove short-lived, as in the core countries much of the radicalism of the 1910s and 20s was slowly exhausted, and finally redirected very effectively by depression-era bourgeois-labor governments of compromise.

Emmanuel for his part thought that re-proletarianization was unlikely to occur without the intervention of OPEC-like associations of peripheral governments (it is not stated whether these would be bourgeois or workers’ governments), demanding higher prices, with the increase in costs passed onto workers in the core. “The possibility would then be created for a massive and brutal re-proletarianization of the worker aristocracy of these countries with the revolutionary perspective that implies.”[27] Price rises on peripheral products, such as during the oil crisis, did indeed exacerbate the immiseration of a section of the core working class. In the US this immiseration had in fact begun several months before the oil crisis, a side-effect of the loss of US competitiveness on international markets, the abandonment of Bretton Woods, and the ongoing reorganization of manufacturing. Amid the resulting stagnation of some core wage rates, it was common enough to find Marxists arguing that this was the final nail in the coffin of the labor aristocracy idea.[28]

Many Marxists have proposed means by which the labor aristocracy would be re-proletarianized, and many have been proven prophetic. Yet the same morbid symptoms continue to reappear. With every passing epoch of capitalism, a part of the core proletariat is elevated while another is immiserated, creating the illusion of general decline to some. The tendency for some privileged strata, such as skilled workers, to see declining special wages relative to rising general wages has been very real. However, this has not stopped the formation of new privileged strata, nor the concentration of high wages in a few countries. In most decades of the 20th century, the average wage rose in the core countries, while many Marxists spoke of the coming immiseration of the whole working class.

This is not to downplay the very real factors that do counteract the aristocratisation of labor. We will see in the next section that there are many more to discuss. But it is a general pattern that many Marxists have assumed that the sum of the equalizing, immiserating factors will come to outweigh the stratifying, enriching factors. It is not out of the question that this should occur eventually, but it has been the mistake of these Marxists to prematurely assume that their generation is the one that will see the scales tip for good.

This is not my main critique. I am much more concerned by the fact that it has never been made clear why immiseration should itself lead to revolutionary consciousness. This misidentification of immiseration with radicalization seems to rely on the false notion that lower strata have a natural predilection towards progressive consciousness, and ignores the dynamics of privileged strata in decline.

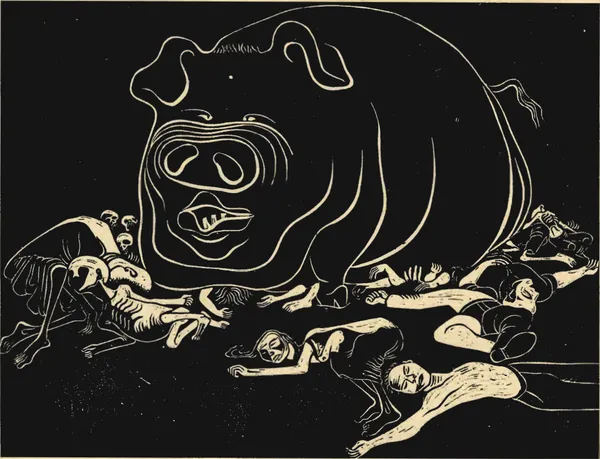

When elevated strata fear their reincorporation into the broader working class, it seems to be their tendency to bloc together much harder, organize themselves into exclusionist formations, and find allies among the powerful, pulling out all stops to prevent their decline. This was the origin of many craft unions, as skilled workers feared reabsorption into the mass of unskilled labor. When the whole class is in a period of immiseration, privileged strata do their utmost to make sure those below them bear the greater burden. While it is true that in a situation of crisis, many workers of all strata will turn towards revolutionaries, it is just as true that many will become attracted to fascism and other reactionary politics. Immiseration should not be seen as necessarily leading to re-proletarianization, much less a proletarian politics. Rather than being preordained, the outcome of this process depends upon the result of several struggles. The labor aristocracy may well prove capable of weathering the storm and simply offloading the costs onto poorer strata. Moreover, even if a section of the labor aristocracy is actually forced down into the proletariat proper, it nonetheless remains an easy target for reactionary politics promising national rejuvenation and restoration to its former status. Or, it may be the case that a section will find itself with lower wages, but will instead be employed in a sector that is vastly harder to organize, as occurred when aristocratized manufacturing jobs gave way to casual or contract service work in many core countries. Periods of decline produce political outcomes that depend on many unknowns and struggles. Immiseration may certainly create opportunities or at least room for maneuver, but positive outcomes depend on a subjective factor of class leadership by revolutionaries.

The terms on which re-proletarianization takes place are fundamentally beyond our control.[29] We do not determine which power can maintain its trade monopolies, when periods of inter-imperialist rivalry begin or end, nor what policies peripheral bourgeois governments will pursue. We can write as many programs for the bourgeoisie as we like, but god only knows why it should listen.

As far as a revolutionary program is concerned, there is no real point in assuming re-proletarianization will occur. If it does, then the political outcome will not necessarily be positive, and will depend on the strength and position of existing revolutionary forces. If it doesn’t, then we have little choice other than to go on amid imperfect conditions (as many have done before), building up our strength in whatever ways are available to us. While capitalism’s internal contradictions will surely accelerate its decline, it is hardly collapsing according to a strict schedule. No endogenous economic rebalancing is necessarily coming, in fact depending on such hope only delays action. Privileged strata may stay with us until the sun burns out, so long as there is no conscious international proletarian force willing to treat the division of the class as a wound, a divide in its own flesh and blood, that must be healed.

2.2: The Economic Effects of Labour Aristocracies

A high degree of economic development creates a fertile ground for labor aristocracies to grow from the unions and labor parties, but its cause is in the last instance political, coming as it does from outside the interests of capitalists. There has been plenty of focus on the economic determinants of a labor aristocracy, but not so much on its economic effects. It can be assumed that there are extraordinary consequences for any change involving such magnitudes in something so definitionally interconnected as an economy. These have been felt principally in their impacts on investment, the terms of trade, and the sectoral composition of core economies.

2.2.1: The effect of wage increases on accumulation

High wages can lead to an increase in the overall capital accumulation in a country or set of countries. They do this primarily through the associated increases in effective demand. However, we should not treat effective demand as a factor of growth in the same sense as extensive and intensive sources (capital widening and capital deepening), nor is it so simple a matter as “demand creating its own supply.”[30] There are several discrete processes by which higher wages can contribute to accelerated accumulation in a country: 1) higher effective demand for wage goods reduces (but does not wholly overcome) the effects of a tendency towards overproduction inherent to the process of commodity realization; 2) higher local effective demand can lead to a concentration of global investment in local production for internal markets (but only in the case of goods which must be produced locally) and 3) higher wages can lead to better terms of trade and specific patterns of specialization for local industry, and this can concentrate global investment in a country’s export sectors despite a lowered rate of profit (such cases are discussed in the following section).

It is worth noting that all of these processes are general, long-term phenomena which do not result in the kind of short-term advantages capitalists typically seek: higher wages will still usually lower profitability and competitiveness. Thus, although the structure and stability of the core economies are largely predicated on their higher wage costs, there is little reason why any one firm would voluntarily shoulder these costs.

Whereas in the 19th-century capitalism in the core countries was still typified by frequent overproduction, deflation, unemployment, and growth rates of 1% or lower, in the modern-day developed countries there is instead a relative absence of overproduction, as well as inflation, high employment, and growth rates always higher than 3%. In the periphery from decolonization to the present day, it is the former conditions that continue to prevail. The dividing line between the two worlds was vast wage increases, indeed the period of the highest growth in the core countries (average rates above 4%) was also the period of the most dramatic divergence in global wages (1950-1970).[31] Wages had this effect due to a basic difference in the kind of effective demand they create, versus that created by profit income, noted by Sismondi and Rodbertus: the wage can be mobilized before sales, and profit after. If the part of surplus value distributed prior to sales is fixed, then wages can only vary inversely with the profit of the enterprise (the part of surplus value distributed after sales).[32] If capitalists were to rely too heavily on the effective demand denoted by profit, then it would be permanently insufficient to realize the full social product: the demand necessary for sales could only arise through the completion of those sales!

This requires some justification since it is sometimes accepted that in the last analysis Marx accepted Say’s law, ie. that there is a tendency towards equilibrium in production and purchasing power.[33] This contains some truth: in his analysis of expanded reproduction, Marx shows a loose tendency towards equilibrium between the demand for wage goods and total wages paid, between the consumed part of total profits and the demand for luxury goods, and between the capitalized part of total profits plus total constant capital consumed and the demand for means of production. Any incidental shortfall in demand or investment within one of these three departments of production would create a tendency towards a proportional rise in another. On the other hand, Marx is also clear that this tendency towards the equilibrium of production and consumption can be negated through a general abstention from capitalists’ consumption – the hoarding of money – leading to overproduction. He even provides a potential cause: “The difficulty in selling … arises simply from the purchaser’s ability to defer the reconversion of his money into a commodity.”[34] However this does not yet explain the reason for that deferment, nor does it imply net hoarding so much as random hoarding negated by the law of averages.[35]

If we seek a potential cause for “the universal simultaneous formation of a hoard” in Marx then answers are more scanty. To greatly simplify things, if there is a fall in the average profit of enterprise as well as a general fall in prices, such that occurs at points in the business cycle, and which is exacerbated by the tendency for the rate of profit to fall, then this can cause a universal disinclination to invest in the next production cycle. As the rate of investment in production and loan capital are mutually opposed, this leads to a growing reliance on credit and a rise in interest rates. This adds to the disincentives to invest, and the money reserve held by the banks grows as no new loans are granted. This money reserve constitutes general, social hoarding, and the resulting disequilibrium between production and effective demand would be equivalent to the quantity of excess credit money in circulation. It is not even necessary for this hoard to actually be achieved for an overproduction crisis to occur: the panicked flight from various industries in the search for liquidity would explain it well enough. Thus there was no real need for Marx to explicitly agree with Ricardo and Say or Sismondi and Malthus on whether there is actually an equilibrium of production and effective demand for his account of hoarding to be sound. Still, this leaves the important question of equilibrium open: Marx made statements that can be interpreted as for and against such a tendency, however most Marxists of the 20th century operated within the assumptions of Say’s law (and indeed within many equilibrium assumptions), and only recently has this consensus been reversed.[36]

If we wish to explain how a specific overproduction crisis can occur within the confines of Say’s law, as historical Marxists did, we would be forced down three different theoretical routes:

- Overproduction is the result of the anarchy of production, due to inadequate assessments of demand by any branch of production, causing general disequilibrium.

- Overproduction is the result of general, constant disproportion between the three departments of production (means of production, wage goods, luxury goods).

- Overproduction is the result of a specific disproportion between departments I and II, ie. between the production of means of production and the production of wage goods. This was the position of Lenin and Luxemburg, in different variants.

The first two of these would not cause an overproduction crisis since this would be canceled out by the law of averages, ie. there would be disproportion in the other direction by other branches/departments at any given time, and there is no theoretical reason why one particular set of branches or one particular department should outweigh the others. The last can be discarded through Tugan-Baranovsky’s well-known objection that the mobility of capital means that investment can simply be transferred between departments until proportionality is restored, since there is no reason that a producer of raw materials would not invest in wage good production if his own profits are declining. If we wish to explain persistent overproduction crises it is necessary to look not to the anarchy of production, nor to the disproportion between productive departments, but rather to problems of general disequilibrium.[37]

Emmanuel proposes the existence of exactly this kind of disequilibrium, which explains Tugan-Baranovsky’s observation “in the capitalist economy, it is more difficult to sell than to buy.”[38] This is the disequilibrium between the total commodity values as they exist prior to sales, and the total purchasing power available at that moment. The total value of social production is equal to total constant capital (we are for the moment assuming a constant rate of turnover of 100%) plus total variable capital plus total surplus value. If we assume there to be a new cycle of production in which no unsold commodities or unsatisfied purchasing power yet exist, and we put one infinitely desirable product on the market at a price equivalent to its commodity value, then what purchasing power would actually exist to buy it up? Classical economics would suggest that the purchasing power necessary to buy it all already exists, a power equivalent to the sum of all revenues regardless of when and how these revenues are distributed. But it seems clear that purchasing power would not yet be sufficient, as it would instead be equivalent to the sum of those revenues distributed prior to sale alone. Quantities of the product would go unsold, as at this moment net production would be greater than net purchasing power, with the difference between the two equal to the enterprise profit, the revenue distributed after sales, or the total prices minus total value. The disequilibrium at this moment can be expressed in the equation:

P > R

While the condition of equilibrium would be:

P = R + p

Where P (production) equals the total social product that must be realized to avoid overproduction, equivalent to the total cost price plus profits, R (revenues) equals the total social purchasing power able to meet it, equivalent to the total costs to the capitalist prior to sale (constant and variable capital plus the fixed part of surplus value) and p (pure profit) is the variable part of surplus value that exists only after sales, equivalent to the profit of enterprise. Since p does not exist when the commodities enter the market, the equilibrium condition is never met.[39]

It is easy enough to see that if we were not abstracting from real production cycles to such a degree, then a part of the profits of enterprise from the last cycle might yet exist to absorb the remaining unrealized product of the present cycle. However, if we add all of our complicating factors back in, the disequilibrium does not actually disappear, it is only muted. It is true that with each exchange, another part of the profit of the enterprise is freed up, and begins to circulate, adding to the available social purchasing power, but it is never possible for the full profit of the enterprise to be released in time for purchasing power to catch up. This is because, assuming extended reproduction, the profit of the enterprise being released in the last cycle will always be less than the amount required to realize the overproduced part of the new cycle, which is larger due to accumulation. So long as there is any general delay between social sales and social purchasing, this disequilibrium remains, indeed it can only be resolved by every capitalist purchasing before selling, ie. general overtrading, which is usually avoided due to the unsustainable lending it would require.[40]

From here overproduction interacts with a number of compounding factors such as hoarding and deflation, which are less our focus. All of this is only interesting to us for the impact that the formation of large labor aristocracies has had on the initial problem of general overproduction. Other factors, mostly other incomes distributed prior to sale, play the same role as wages. A rise in the profits of the banks and landlords would have a very similar effect, and we will see that this is relevant in section 2.2.3.[41]

2.2.2: The effects of unequal exchange

Since all branches of production have different social compositions and rates of profit, wherever capital is mobile, investment will tend to drift away from branches with lower rates of profit towards those with higher rates of profit, whereupon it will tend to lower these rates by oversaturating the associated markets. Changes in price are the mechanism for this equalization of profit rates. Prices cannot be too high or competitors’ goods will be more attractive, and they cannot be too low or it will eat into the enterprise profits and future investment will be discouraged in another way, so prices are restricted in both directions. Having been limited in this way, prices will tend towards a point of equilibrium, whereupon each branch receives the same profits for the same investment, and no further mobility of capital would be encouraged.[42] Thus there is a tendency for the profit rates of all branches in the same sphere to move towards a general rate of profit. In practice the prices of production and general rate of profit represent only probabilistic tendencies, points of attraction which can be negated in many ways, and uniform prices and rates of profit are rare even where capital is very mobile.[43]

If we assume for the moment a constant rate of surplus value and an equal level of technological advancement, then the branches with a higher ratio of constant capital to variable capital will, through the formation of a general rate of profit between competitors, tend to sell their goods for the lowest price, while still receiving the same profits per unit of investment. For the moment it is safe to assume that such a capital-intensive branch will produce the most use-values, and so these lower prices of production also correspond to lower unit prices. These prices will tend to be higher than the money-value of the abstract labor time socially necessary to reproduce these commodities. Conversely, the branches with a lower-than-average proportion of constant capital will have prices that are lower than the money-value of their commodities. Since the difference between the low values and relatively higher prices of the more competitive branches is precisely equal to the difference between the high values and relatively lower prices of the less competitive branches, it’s tempting to think of this as a “transfer of value” between branches, but this is useful only as shorthand for a more complex process. What is actually occurring is that as-yet unrealized quantities of surplus labor, which cannot be realized in the prices of the more labor-intensive branch’s commodity, are instead being realized as part of the prices of the more capital-intensive branch.[44]

On a more concrete level, the mechanisms by which these differences play out is in market shares and the rate of investment: the more productive capitals (those with the lowest sustainable unit costs) will have access to a greater market share, and the uncompetitive capital, despite receiving the same profits per unit of investment, is consigned to a lesser share. At a given value composition and general rate of profit the less productive branch can only match the market prices – and thus threaten the market share – of the more productive branch by forgoing its own profits, but this is undesirable in this situation as without a greater mass of sales it would discourage future investment.[45] However, given the free movements of investment between branches, each branch has the ability to reorganize production along more capital-intensive lines, compensating for reductions in the rate of profit with increases in its mass. The first branch to reorganize in such a way often gains a “first mover advantage,” receiving outsized competitive benefits and forcing all other branches to match its rate of profit. Over time significant competitive differences in composition are thus erased by the mobility of capital between branches. The mobility of the capital factor is therefore both what allows (or forces) heterogeneous branches of capital to compete with one another at a general rate of profit, and the thing that will tend to negate their heterogeneity.[46] We have already seen, however, that there are significant factors acting to distort this movement of capital, as global investment is concentrated in a handful of countries.

Under the Ricardian doctrine of comparative advantage, there was no such mobility of capital across national borders, indeed the theory only made sense if national capital was forced into investment in the most productive national industries rather than investing in the most productive industries anywhere on earth.[47] Of course, in reality, capital is quite mobile across borders, and the phenomenon of deindustrialization, however much it has been exaggerated, has made this undeniable. This would seem to suggest a tendency towards international equilibrium prices and the formation of international general rates of profit for various sectors. However several problems are immediately identified if we attempt to apply a Marxian theory of prices of production onto international competition while continuing to abstract from the question of wages and technology, which are often roughly equal nationally but wildly unequal internationally. These problems can be expressed as three questions to be answered:

- Why have vastly higher core wages not led to the concentration of investment in the low-waged countries, where the rate of profit is often held to be higher?[48]

- Why do capital-intensive countries prefer to trade in goods produced by industries with a low capital intensity (the Leontief paradox)?

- Why did the terms of trade for poorer countries decline over the mid-20th century despite conditions which should, in classical economic theory, lead to gradual improvement in their competitiveness (the Prebisch-Singer phenomenon)?[49]

These three questions are answered if we add to our analysis of nonequivalence in the organic composition an analysis of the nonequivalence in wages.[50] This is a phenomenon Emmanuel called unequal exchange, which he summarised in the following theorem:

If the wage is exogenous (institutional, independent variable), and if a tendency exists for the formation of a general International rate of profit, then any autonomous variation in the wage-rate in one branch or in one country will entail a variation in the same direction of the respective price of production and a variation in the opposite direction of the general rate of profit.[51]

In other words: if there are two or more trading partners that are competing for the same mobile pool of capital, a general wage rise in one country without a corresponding increase in the surplus value contributed by labor to its commodities will result in that country having a higher price of production (which we must remember does not necessarily correspond to unit prices, but to the sum of prices for a given quantity of invested capital) for its total production relative to total commodity values, regardless of the initial value composition of its industry. In contrast, all other countries which did not see such a rise in wages will see lower prices of production relative to initial commodity values. To improve the terms of trade at the expense of profits is hardly a goal of capitalists, but in this case, it is not their choice – the wage rise is pursued not by the capitalist but by the unions or state. Luckily for the capitalists, the overall reduction in profits is compensated by a major change in the terms of trade. The capitalist of the richer country gets access to cheap elements of constant capital from the poorer country, while the poorer country must pay even more for high-value-added goods from the core. This leads to a change in the single and double factorial terms of trade for the richer countries, and the commodity terms of trade for the goods they usually export. This tends to exacerbate economic specialization along entirely irrational lines, with poorer countries exporting for highly competitive markets in low-value-added goods to pay for costly imports. In short, core producers can ‘buy low, sell high’ without the usual limits set by competitive pressures.

Peripheral capitalism is not powerless in the face of unequal exchange. Indeed a peripheral country with low wages but decent education, technology, and value composition can counteract and reverse some of the distorting effects of unequal exchange on competition, but this is difficult for most without access to foreign backers or significant economic planning.[52] Indeed the few instances of poorer countries escaping the ‘middle-income trap’ in the past century have either involved anomalous exports of fixed capital from a richer country consciously seeking to offshore its manufacturing or the establishment of a planned economy.[53] Wages could be increased, but this is limited by accumulation and competition, and could only be achieved in export branches with very high-value compositions (like oil) or internal branches not subject to foreign competition, which requires protections.[54] It is sometimes contended that peripheral economies cut their wages and intensify exploitation to regain their competitiveness, however, while this would indeed confer short-term advantages in competition with other peripheral sectors for investment and market shares, it would have the opposite effect on the terms of trade.[55] A more coldly logical response by peripheral capitalism to its declining terms of trade – which also assists in its competitiveness – is to slash employment and reorganize production on a more capital-intensive basis, and this is another reason we see higher unemployment in countries with poor terms of trade.

It is also possible for peripheral countries to achieve short-term benefits from the commodity terms of trade for certain goods produced in the high-waged countries, which become inflated through unequal exchange. This is possible so long as the high-waged country is the price-setter, and the low-waged country the price-taker. Sometimes it is possible for low and high waged countries to compete in the same markets – see for example Brazilian and Australian high-grade iron ore, or Romanian and New Zealand pinewood – and both countries will seek competitive advantages on the basis of capital deepening, technology, and the rate of surplus value. In such a situation the peripheral capitalists have a fighting chance due to their lower and more elastic wage costs; however, if they are so successful that investment patterns shift and the peripheral country becomes the primary price-setter, then the commodity terms of trade will decline due to unequal exchange. In practice, such competition without any product differentiation is rare, as it is often not possible for low-waged countries to invest in the production of commodities primarily produced in the high-waged countries for reasons of skill intensity, technology, high initial costs, or climate. However it has occurred enough times to see a general pattern: wherever complex production has been allowed to shift to the low or middle-income countries, such as occurred with many products during the 1980s, the terms of trade have undergone a steady drop.[56] Thus even where entry into markets monopolized by the high-waged countries is possible, it is not possible for the low-waged countries to “win” through becoming the primary producer of any particular product, at least in the long term, as they will only succeed in lowering the commodity terms of trade for that product. Modest gains can be made by becoming one of several competitors in a sector where the high-waged countries are the price setters. However, this opens the peripheral country up to added competitive pressures, which will negatively affect its workers either through technological unemployment or a higher rate of exploitation.

To return to the three questions we initially asked: through unequal exchange the terms of trade for core production are increased despite some loss of profits, meaning that the limitations we might think wage rises would impose on international competitiveness do not necessarily apply. There is an incentive for core capitalists to search for ever cheaper elements of constant capital to make up for higher wage costs, and thanks to these lowered constant capital costs compared to higher wage costs, core exports are often labour-intensive. Finally, the mass of profit on core exports is increased as peripheral countries are forced to pay more for less, and this leads to lower unemployment and a higher money supply (effects of a positive trade balance) in the core, and the opposite for increasingly export-dependent peripheral countries. In this way, our questions are answered.

Another secondary benefit of unequal exchange is that the higher trade surpluses it encourages act as another countertendency to the problem of general overproduction. This bears a similarity to the argument of some Keynesians that, provided trade removes the number of commodities on the home market without changing the effective demand facing them, the result would be straightforwardly beneficial. However this is only the case if the surplus is settled as inflows into central bank reserves, or as payments to cash exporters, and not as acquisitions of foreign holdings.[57] The old mercantilist belief that selling without buying represents an economic victory is not so archaic.

These benefits aren’t felt only by the capitalists of the richer country. It is also often said by third-worldist authors that the working class of that country exploits the periphery through unequal exchange, since their rise in wages has effectively been subsidized by placing additional competitive burdens on other countries. However, this confuses the benefits of unequal exchange with the benefits of wage rises themselves. Unequal exchange is, in many respects, not a theory of why some places develop vastly higher wages, but rather why some wage increases are retroactively beneficial for capital in the long term. Strictly speaking, the workers of the core gain no additional benefit via unequal exchange aside from potentially cheapened wage goods (discussed below) – it is not as if core capital fights their wage increases any less. To say ‘the labor aristocracy benefits from immiseration in the periphery’ likewise confuses the chain of causality – it benefits from one process (state or union-led wage rises), which causes another (UE), that in ordinary circumstances pressures peripheral countries to reduce employment and specialize in undervalued goods.[58] Nor do I think there is much truth behind other more modern claims by authors drawing from Emmanuel, such as “negative rates of exploitation” at one pole and super-exploitation at another, or “transfers of value” between working classes.[59] Too often, these claims confuse debates and contribute to a caricatured view of any politics which might deal seriously with the problems posed by trade imperialism.[60]

What is the theory of unequal exchange, stripped down to its political implications? It’s little more than a theory of why high wages in the developed world were tolerated for so long, a theory of why the “victory” of higher wages did not significantly harm the capitalists.[61] To speak about the damage it wreaks in terms of so and so many hours of labor uncompensated or x amount of surplus value transferred misses the point. The damage wrought was already self-inflicted by our class thanks to the repeated political defeats of internationalism through the 20th century, and a subsequent failure of the class to look out for its members with the least bargaining power. The unevenness and incompleteness of the gains of a misled class struggle in the era of imperialism itself explain much of the developmental divide the world is stricken with – unequal exchange and other non-equivalencies are only secondary factors that followed this initial failure.

The specific effect of unequal exchange on the balance of trade has been entirely overridden in the United States and several other core countries, although the underlying process is still present in the terms of trade. Since the abandonment of the Bretton Woods system in 1971, the US saw a significant downward trend in its trade balance alongside the first stagnation in real wages in decades.[62] Indeed in the new order a negative trade balance came to be seen as a healthy economic indicator by monetarists, although this would be entirely delusional if applied outside of a select few countries. Today only the core countries with significant manufacturing or primary industries are net exporters (Scandinavia, Germany, France, Japan, South Korea). The US is the biggest net importer in the world, and this has led to a savings deficit, with a current account balance under negative $650 billion. However, the negative effects that would normally be felt in terms of a balance of payments crisis and high unemployment have not materialized due to the privilège exorbitant of the US dollar as the global reserve currency.[63] US imports are bought in US dollars, and profit is always higher than interest expenses. This has also led to an increase in the valuation of US-held overseas assets, leading to more repatriated profits from direct investment.[64] Several other countries with significant finance centers are bound up in the system of dollar privilege, such as the UK (or just London), whose economic function was for many years to profit off of international capital transfers (much of it leaving the US) as a Eurodollar funnel. Abuses of the privilège, such as economic sanctions as a weapon of imperialism, are presently leading to a potential abandonment of the US dollar as a global reserve. Indeed the only reason this has not already occurred is that no other currency is a viable sole alternative. If this trend continues we will see if the US and its finance colonies are truly exempt from the usual economic limits.

Does the existence of the US trade deficit and its failure to result in many negative effects constitute an empirical refutation of unequal exchange? On the contrary, it affirms several of Emmanuel’s basic predictions despite a drastic change in the global finance regime. Commodities from the core do still sell for higher prices, reflected in the terms of trade, even in cases where there are no major differences in the manufacturing process. Growth or decline in real wages is broadly linked to the trade balance. While this has not always led to core countries gaining a trade surplus, it is clear that without unusual financial privileges, a large trade deficit not offset by overseas investment income still results in deflation, unemployment (at least in manufacturing), and eventually a balance of payments crisis, a very real possibility for much of the world. Many core countries are once again seeking greater protections despite the protests of their economists, something which core manufacturing capital has wanted for a long time.[65] The effects of UE are still felt, but such abstract theorizations rarely describe underlying phenomena which manifest in a pure form, and we should be cautious before assuming fundamental tendencies are not negated in whole or in part in the course of history.

2.2.3: The effect on sectoral composition, and the rise in socially-necessary unproductive labor

Much has been made about the rise of the service industry across the world in recent years, which now constitutes 51% of global employment. What is interesting about this rise is that the conversion of some 17% of the global working class into service workers has occurred only in the last 30 years, a rate of conversion which shows no signs of slowing.[66] Unfortunately, the service sector as it exists in most accounts is an inherently mystifying agglomeration of different forms of work that includes both productive and unproductive labor (of varying degrees of social necessity), and even the production of some physical commodities (eg. those which are consumed quickly, or which involve vertical inputs incidental to a service). When I speak of the rise in service work, I am not speaking of the forms of service labor that have existed for a very long time in roughly equal proportion to the rest of the economy (work in food distribution, healthcare, education etc.), but rather newer or growing forms of work in media, legal, property, information and financial services. Some of this work is productive of social surplus value, but the bulk is what we can call circulation labor and social-maintenance labor, labor that assists in realization rather than production. It has been the mistake of many Marxists to consider this labor simply parasitic, existing only to “absorb social surplus” or somesuch (as if individual capitalists would foot the bill for macroeconomic dangers), as this labor is generally socially necessary in that it is paid out of the fixed component of surplus value in order to maintain certain conditions of reproduction and realization.[67] If this “socially-necessary unproductive labor” is increasing in importance, then at an abstract level this phenomenon may reflect another attempt by capital to avoid problems of realization, while at a concrete level the goal is to gain advantages through more efficient circulatory practices or to accumulate greater financial revenues.

This explains the bulk of the growth in unproductive service labor, such as that employed by private industry as an additional in-house overhead cost (eg. cleaning or maintenance labor), or that employed in most state and financial sector jobs. The more modest growth in productive service work, such as in hospitality roles, or contracting firms hired out by the state or private industry, is instead related to partial deindustrialization, the growth of large internal markets in the core, and the privatization of state services. The difference between productive and unproductive service labor has little bearing on which sections of labor are aristocratic, as both categories include vastly different rates of pay and benefits. The rise in service work has prevented much of the unemployment that would otherwise have resulted from the decline in manufacturing, and moreover, it has accelerated the decline of the unions, since such workplaces often have smaller, more casualized workforces that traditional unions struggled to reach.

There are certain sectors of the core economies which have grown in order to better take advantage of aristocratic wages. This is true of commercial capital, especially the major retailers. The function of commercial capital has always consisted in acting as a middleman between production and consumption with a profit that corresponds to a portion of the difference between the supply value and the ‘real’ price of production, the equilibrium price of goods at the final point of exchange.[68] However commercial capital in the developed countries has been supplemented through an increase in the difference between the price of goods bought from importers and local consumption, an increase that corresponds to the increased share made possible by reductions in the price of some imported goods through unequal exchange. A high local wage and mass of profit mean a consistently elastic demand for such goods, relatively undiminished by this markup.

Much of this profit has not gone to retail capital. On the contrary, the growth of trade and relative opening up of protections over the last half century has lengthened supply chains and caused a concentration of profit among intermediate capitalists profiting off shipping, packaging and distribution. US retail profits relative to their upstream suppliers nearly halved in the decade between 1998 and 2008.[69] Retail has always had relatively thin and unstable profit margins and this has been exacerbated by longer supply chains and pressure from upstream profits.

In the last half-century, retail in the core has become characterized by vast oligopolies (or more accurately, oligopsonies), including companies that often constitute the largest corporations in their respective core countries (Aldi, Walmart, Woolworths etc.), able to decide the fates of peripheral and local producers and exercise considerable control over the distribution of wage goods.[70] The management of the vast supply chains and very high circulation costs in commercial capital necessarily leads to higher returns to scale, and to oligopsonization, but it is doubtful such oligopsonization would have been so extreme without the effects of general wage increases on effective demand for wage goods. In contrast, the oligopsonization of retail in poorer countries did accelerate through the 1990s, where oligopsonies were still able to muscle out competition through economies of scale, but without artificially high demand and cheapened inputs through unequal exchange, these efforts have been markedly less successful.

It is sometimes argued that the labor aristocracy of the core countries mainly benefits from unequal exchange through cheapened peripheral goods, but this doesn’t seem to be the case. The main benefit to them has already occurred through wage increases out of proportion with the rate of surplus value, and any savings from the declining terms of trade in peripheral wage goods largely go to commercial capital. After markups, peripheral wage goods are often only marginally cheaper than core goods to the final consumer. In the case of goods produced in the core, using cheapened peripheral inputs, this would result in a general decrease in prices, however, any deflationary effect is wholly counteracted by the effects of increased investment and reduced overproduction, which are very inflationary.[71]

Retail is not the only sector that has grown and changed form in order to better profit off of greater wages in the core. The aforementioned growth in property, information, and financial services (or Finance, Insurance, and Real Estate – the FIRE economy), has been in part dedicated to consumer services, which should be considered as part of the bundle of wage goods. The management of interest, premiums, rent, and debt, on the other hand, is an unproductive process that represents a transfer of value from production to the finance sector, much of it through the intermediary of real estate (the largest sector in developed economies).

Finally, there is a tendency in the most obscenely corrupt states, where the workers’ movement is at its weakest, for the state to subsidize the tax bill of the richest capitalists through a special levy erected on lower tax brackets (such as FICA paycheck withholding in the US), effectively another value transfer through the state as an intermediary.

Michael Hudson is right to say that a majority of the US wage bill is actually reabsorbed through financial and state mechanisms that confer disproportionately small benefits: 40% is spent on mortgages and rents, 15% goes towards servicing other personal debts, regressive taxation takes another 21-26%.[note]

Michael Hudson, “From Marx to Goldman Sachs: The Fictions of Fictitious Capital, and the Financialization of Industry” Critique 38, no. 3 (2010): pp. 435–436. http://gesd.free.fr/hudsongs.pdf.[/note] But we should be careful not to uncritically accept Hudson’s framing that this is all pure “parasitism,” or his broader politics of saving the good, productive economy from bad, rent-seeking finance. Finance, even in this often high-interest, predatory form, plays a necessary role in capitalist reproduction in allowing workers with access to credit to sustain a higher standard of living despite precarious employment and fluctuating prices (not to mention its necessary role in capitalist accumulation). It is also a testament to how high some US wages are by global standards, that despite these enormous additional costs, the average remaining weekly share is still enough to fulfill the most basic needs of four adults at average prices.[72] Of course, these costs are not shouldered evenly: some costs disproportionately affect the poorer proletariat, while others chiefly affect the labor aristocracy, a large part of which also has access to profit income, a factor not taken into account here. The increasing burden imposed by the financial system is the strongest countertrend to wage increases in some countries, but it is hardly enough to negate them entirely. Instead, this burden is another factor explaining why a non-aristocratic proletarian minority persists even in very high-waged countries.

Considering the role of fixed revenues in curbing the tendency towards overproduction, the rising role of loan capital also explains why we have not seen as much of a renewed tendency towards overproduction, unemployment, and slowed growth in the core as we might expect. A reduction in effective demand, such as would result from the massive financial costs now taking up a large part of the wage, would be very dangerous were it not for a roughly equal tendency for larger financial rents to be levied, and thus reduce the disequilibrium in another way. We could say that finance capital has saved recent capitalism, were it not finance that had also endangered it.